Who is thriving in this crypto winter?

- Harvey

- Mar 10, 2023

- 5 min read

Updated: Apr 22, 2024

Who is the Google of Blockchain?

Transparency is a key feature of blockchains and whenever you want to assess any transaction data on blockchains you can pull up the data and conduct your analysis. However this seemingly simple process of retrieving and organising data is actually logistically complicated. For example, you need to run your own full node in order to have access to the full data history and this requires both technical know-how as well as financial costs. Or you need to decode the data bytes in order to have the data in a readable format. To index this data and organise them into relational databases require something like a Google that constantly updates these databases (or tables) and serving them in a neat format to projects or developers who need them.

Enter the Graph. Graph is aiming to be the indexing layer for blockchains. It is comprised of a decentralized network of participants who source, build, and maintain blockchain relational databases called subgraphs for developers to query from. It currently is the only fully decentralised and operational blockchain indexing and querying on Ethereum even though it offers hosted data on multiple chains. The most interesting data on Graph itself is the explosive growth in its query fees generated in the last 8 months. It has gone hockey-stick.

Such a growth metric is impressive in any market let alone in the depth of the bear. Before we look at other data to corroborate or invalidate this metric, let’s first understand the participants and the economic design that runs the ecosystem.

The Graph Network Participants

The Graph has a two-sided marketplace that matches the provider of query data and the customer paying for these data. On the demand side, end users’ query payments drive the growth whereas on the supply side there is decentralized network of the following roles. And the GRT token has the following economic designs:

Indexers are required to stake GRT to run Graph nodes and to provide good indexing and query services to end users. The minimum is 10,000 GRT. The amount staked directly impacts the volume of queries they can service. The staked amount is slashable in case of malicious behavior by 2.5%, half which is burned.

Indexers earn both query fees and token emission/incentives called indexer rewards. There is a 1% burn mechanism for query fee paid. The annual 3% token emission is distributed pro rata according to the total GRT an indexer allocates to their subgraphs. The total amount allocated is equal to their own staked amount and the delegated amount. For indexers with smaller capital base, they can attract delegators to increase their total bandwidth to service queries and earn more emissions.

Delegators stake their tokens on indexer's open APIs up to 16x the indexer's own staked amount to earn a cut of the query fee generated AND the GRT emission rewarded to indexers. Every time a delegation is made, 0.5% of the token delegated is burned. Delegators’ tokens cannot be slash when an indexer is penalized.

Curators stake GRT to signal which subgraph they believe Indexers should build open APIs for. They will earn a % of the query fee generated by that API. Every time a curator signals with their GRT token, 1% of the signalled amount is burned.

End users pay indexers for using their services. End users can pay in multiple currencies but these will be converted to GRT tokens automatically so indexers will receive GRT tokens as payment.

As you can see, more GRT is required from Indexers to be staked when there is more query volume demand. Reflexivity anyone?

The Graph Network Health Check

Since its launch in 2020 Dec, Graph has seen its circulating token supply increase from 1.2bil to 7bil approx. today. Despite this enormous inflation, or precisely because of it, Graph’s tokenomics has managed to incentivize a strong network of participants in its ecosystem.

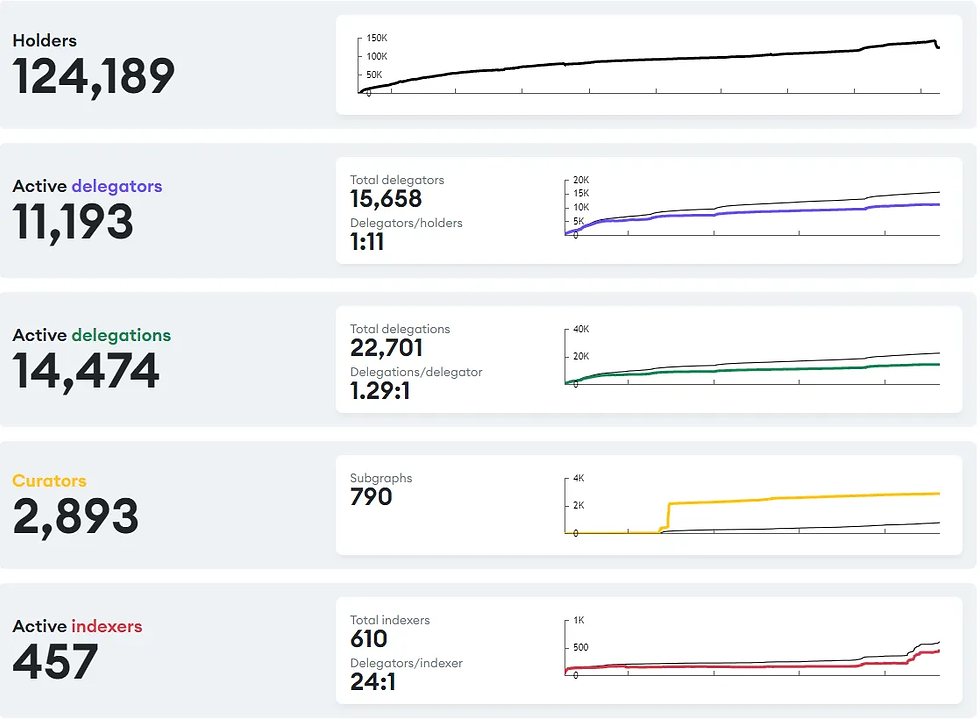

With close to 125k holders, 11k active delegators, 2.9k curators and 457 active indexers, Graph has seen healthy growth since the launch with every category of participants trending upward, when compared to its closest competitor, Covalent, which we will look at below. Graph has by far the most decentralized and engaged network of participants measured by the number of participants in different roles and the highest staking rate at approx. 40% of circulating supply.

Supply and Demand Dynamics

With 2bil GRTs left to unlock in two years until the initial allocation of 10.5bil GRT becomes fully unlocked, the supply side will face 15%+ annual inflation pressure until 2025 after which the inflation will drop to the annual emission of 3%. If Graph can successfully scale the demand side of its query marketplace in the meantime, it has much upside potential, especially given its current fully diluted market capitalization of less than $1bil. For context, Infura and Alchemy, two centralized competitors, have raised at $7bil and $10bil in 2022 respectively.

However, the query demand volume is currently averaging 848k GRT for the last 3 months whereas the emission alone will be at 300mil GRTs a year from 2025 once the initial allocation is fully vested. In order for demand volume to 100x and annualise at around 300mil GRT a year, Graph needs to either have enough runway and wait for the overall crypto market to grow, which they may be able to do given they have raised more than $65mil, or they need to develop and bootstrap new markets. Making multichain data available to end users may be a good first step. The $200mil ecosystem fund to subsidize builders utilize the protocol may further help. Perhaps having incentives to subsidize end users could be helpful to gain market share and mind share in this bear market.

Competition

Covalent was launched in April 2021 to provide a unified API service for querying multiple blockchains and has raised 4 rounds for a total of $14.4mil. In terms of the reach of the project, compared to Graph’s 125k token holders, there are only 7.9k CQT holder according to Etherscan. This 16x difference demonstrates the engagement and mindshare two projects are able to command. Additionally according to the official website, only 19mil CQT or 4% of its circulating supply is currently staked compared to Graph’s 40%. This ten times difference speaks volume about the confidence level of the holders in each project. Recently 33% of Covalent’s Reserve allocation was used to underwrite the 66mil CQT loss due to the Nomad Bridge Hack incident. Whereas Graph has all its four decentralized network participant roles up and operational, the most urgent issue for Covalent may be that its decentralised network has yet to fully come online. As for the demand side of the query fees, Covalent has not made any data public. Given its centralized state, it is impossible to find and verify this information onchain.

We Are Still Early But...

It has to be said that we are still in an early phase of the blockchain indexing and querying development. Yet Graph is the clear category leader and much better positioned than its competition to capture the decentralized blockchain data indexing and query market. While its competitors may have difficulties getting through this crypto winter due to apathy from community or funding pressures, Graph has a much larger community, a more active ecosystem of participants and a bigger financial war chest to weather through the bear market and convert mindshare into market share. Of course execution here will be the key. If Graph can execute on incentivizing or developing new markets for its services, it is well positioned to reap the rewards as the overall crypto adoption grows and blockchain data becomes the oil that feeds the data needs of a multitude of composable decentralized apps.

Comments