top of page

Search

Stablecoin: the King of Digital Assets

World's top 20 stablecoin geographic markets unpacked

Harvey

Jan 15, 20257 min read

3 Digital Asset Trends Shaping 2025 and Beyond

What are the top 3 digital asset adoption trends? Here I distill the most important adoption trends from 2024 that you need to know for 2025

Harvey

Dec 21, 20244 min read

The Silent Threat to The Biggest Tokenization Success

Stablecoin is the biggest tokenization success story but it faces a silent threat that could derail it all...

Harvey

Dec 13, 20245 min read

Tokenizing the $100T Sovereign Debt Market pt 1 - UK to lead the way?

Another week, another busy tokenization announcement calendar with 5 big developments. I published a highlight recap here . Out of the 5, the most consequential has to be the news that the UK government plans to issue digital gilts, the UK government bond equivalent to US Treasuries, on blockchain. Why? Because the fastest growing tokenization vertical - tokenized MMF/US Treasuries - while signalling an insatiable demand from onchain capital to access the US sovereign debt m

Harvey

Nov 17, 20243 min read

Why utilizing is 10x more important than tokenizing MMF?

Last week was particularly busy for tokenization space. There were 5 announcements about the development or the launch of tokenized MMF, including 3 from institutional players. UBS Asset Management launched its first tokenized investment fund, the UBS USD Money Market Investment Fund, on Ethereum. The fund will be domiciled in Hong Kong serving the APAC region with DigiFT as the distributor. Citi and Fidelity International have developed a solution that combines a tokenized m

Harvey

Nov 8, 20245 min read

Financial Services Tokenized Series: Mapping out Standard Chartered's digital asset strategy

Want to what is Standard Chartered's digital asset strategy? Full research here.

Harvey

Nov 1, 20249 min read

Onchain Finance GTM Series: The 5 GTM questions you need to sell your products

Last week was busy. There was a noticeable increase in the number of GTM advisory calls I had. This uptick could be a positive indicator for the space, suggesting a growing interest and confidence. However, a recurring theme across these conversations was the heavy focus on product development. While the passion for innovation was evident, most discussions centered on comparing tokenized products to their traditional financial counterparts. The common consensus was that these

Harvey

Oct 23, 20245 min read

Onchain Finance GTM Series: Where are the top adoption markets for tokenized USD cash products?

In our previous Onchain Finance GTM Series on geographic adoption of digital assets, we looked at the 10 countries with the highest transaction volume in 2023 as well as the top 10 countries by adoption rate. Of course, the US, given its massive economic size, took the No.1 spot based on transaction volume. But is the US the top market for tokenized USD adoption by adoption penetration? Well from an adoption penetration perspective it is far from the top 10 markets. As a rem

Harvey

Oct 15, 20243 min read

Does tokenization really help securities issuers and investors lower cost?

Tokenization saves cost. Does tokenization really save cost? Under what conditions does tokenization make sense? Most readers are likely to be familiar with the first of the three lines from above. Indeed it is the most frequently used marketing narrative in the entire tokenization history. However a builder in the space or an Insiders Club member may find line 2 and 3 to be more representative or reflective of the reality on the ground. Given my GTM advisory interactions of

Harvey

Oct 8, 20244 min read

Onchain Finance GTM Series: Which blockchain to target in your GTM strategy?

In our last week’s Onchain Finance GTM Series, I broke down digital asset transaction data of the top geographies with the highest transaction volume in 2023 . As I was doing tokenization GTM advisory work this week, I was reminded that, in onchain finance, there are additional border lines beyond the physical geographic divide between nations. Not only is the onchain capital separated along national borders, it is also separated along the blockchain network on which it resid

Harvey

Sep 25, 20244 min read

Onchain Finance GTM Series: What are the top countries with the highest on-chain transaction value in 2023?

Is your business ready to ride the wave of onchain capital? Read this to ensure you are well prepared and positioned for success.

Harvey

Sep 16, 20244 min read

Financial Services Tokenized Series: Is Your Bank Ready for Tokenized Money?

With trillions of dollars transferred annually, tokenized money is the undisputed leader in tokenization adoption—dominating the digital asset space far beyond traditional banking while proving its superiority vs the traditional settlement rail. Banks are now racing to catch up, eager to integrate tokenized money into their offerings and avoid getting left behind. But what should banks focus on when designing and launching their own tokenized money products? In this week’s n

Harvey

Sep 1, 20244 min read

Tokenization Explained by Lloyds Banking Group

Lloyds Banking Group recently published an excellent article on the transformative power of blockchain and tokenization. It was the first time a financial institution put out a paper that non-technical readers can pick up and grasp things intuitively. I found its social messaging groups and ship containers analogies to be extremely poignant to abstract away complex concepts and get to the core functional differentiations. To distill the full article into its most important

Harvey

Aug 27, 20243 min read

Onchain Finance GTM Series: What do tokenized US Treasuries adoption stats tell us about the sector?

It’s been 4 months since I published research on why tokenized US Treasuries took off and how BlackRock was future-proofing its asset management business . What has been happening in the meantime in this tokenization vertical? Well in short it has grown 100% YTD. And here are the 3 key trends about its growth: Out of the top 3 tokenized asset classes, tokenized US Treasuries growth outperformed peers by a wide margin Different flavours of tokenized US Treasuries are taking

Harvey

Aug 19, 20244 min read

Onchain Finance GTM Series: How to think about GTM for tokenized cash products?

When I wrote “ What are the different flavors of tokenized cash and which do you prefer? ” two weeks ago, I didn’t know it would become one of my most popular posts to date after BlackRock’s partner Securitize picked it up in its weekly Private Market News post on LinkedIn . In the post, I wrote about the two distinct flavours of top 8 tokenized cash products: store of value and yield accrual. But having had more time to reflect on the data, I am adding another dimension to c

Harvey

Aug 13, 20245 min read

2024 Tokenization Fundraising Data Review

Happy August. I hope many of my readers are receiving this week’s newsletter from somewhere paved with warm white sand and dotted with lazily swinging palm trees. As we savour these warmer months of the year, I thought it would be the perfect time to take stock of the 2024 tokenization market by looking at all the money that went into funding this years’ tokenization startups. Where are investors putting their money? The 3 key questions we are looking to answer: Who are the

Harvey

Aug 6, 20243 min read

What are the different flavors of tokenized cash and which do you prefer?

Lately I have been inundated with client requests for various industry-level reports on the tokenization space. One piece of data that stood out to me as I was going through my research process was composition of the No.1 tokenization vertical: tokenized USD cash. There has been plenty of ink spent on the topic. You can read about its usage breakdown here . But they all tend to treat the category as if every product in the category is similar and homogenous in their makeup.

Harvey

Jul 29, 20245 min read

Financial Services Tokenized Series: How will tokenized MMFs scale to trillions AUM? pt.3

A few weeks ago I started the series “How will tokenized MMF scale to trillions AUM?” We looked at three traditional finance use cases that are likely to adopt tokenization for immediate benefits and that benefits scaled into very large numbers. Having looked at US corporate cash management and derivatives collateral management in part 1 and part 2 , we are wrapping up the series with intraday repo as our last stop. Unlike the other two use cases, intraday repo is a new mark

Harvey

Jul 22, 20246 min read

What are the next scale-up use cases for digital assets?

I recently wrote a post about the 3 proven product market fit areas when it comes to digital asset adoption. One of them is tokenization. Another one is trading. And the last but not least is payment. While the trading business is essentially a commission business dependent on the overall crypto market activity, tokenization and payment are independent from the overall crypto market and have much bigger potential to become foundational building blocks in our financial market

Harvey

Jul 8, 20244 min read

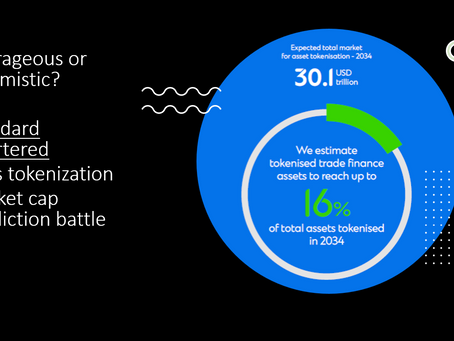

Outrageous or Optimistic? Standard Chartered's tokenization forecast unpacked.

Hot on the heels of the McKinsey vs BCG debate on the future of tokenization, Standard Chartered waded into the battle with a paper that is either going to be the call of the decade or the embarrassment of a gigantic proportion. SC forecasts a tokenization market that is 15x of McKinsey’s base case. With this, Standard Chartered and McKinsey represent the top and bottom range of the forecast numbers. McKinsey - $2 trillion EY - $14 trillion BCG - $16 trillion Standard Char

Harvey

Jul 1, 20247 min read

bottom of page