The Secret Behind BlackRock Tokenized MMF's 8-figure AUM Surge

- Harvey

- Mar 18, 2025

- 5 min read

Updated: May 2, 2025

Last week, BlackRock’s tokenized money market fund (MMF), BUIDL, surged past the $1 billion milestone. marking a defining moment in the onchain financial revolution. Launched on 21 March 2024, BUIDL wasn’t just another product; it was a signal. A starting gun for traditional asset managers to storm the onchain space.

Excellent news article headline.

But the real insight? It’s not in the mainstream media headlines or crypto media soundbites.

It’s time to get granular and dive under the surface.

Consider this:

On Feb 28, BUIDL’s AUM stood at $620M.

By March 17, it exploded to $1.24B.

That’s a $620M+ influx in just over two weeks - the largest capital flow in onchain tokenized MMF history. Given that BUIDL is only open to KYC'ed investors, the sources of these capital inflows would be highly valuable targets for any and all tokenized financial product distributors.

Where did that money come from?

Why are they deploying the funds now?

How much more dry powder is left?

What are the implications for broader onchain finance?

This week, I’m peeling back the layers of onchain capital flows, the largest onchain capital allocation flow, revealing the secrets behind this 8-figure AUM surge and what it means for the broader market.

Let’s dive in.

Where did the money come from?

Given the sudden and massive AUM increase, the first place to look at is where did the capital originate from. Filtering minting or subscription transactions in the product, we have the following transactions.

In total there were 7 significant AUM inflows. 2 belong to the India Covid-Crypto Fund for a total $51M. 5 of them belong to a wallet/entity identified as (0x3a526b3a4e72efb90554b18b6f268ffdc81ccb8b). The total amount minted by this entity was $560M in the last 5 days. Together the two entities added $610M to BUIDL’s AUM.

The math checks out - they are the primary contributor to BUIDL’s AUM increase. Specifically, the mysterious entity who bought $560M was the whale that tipped the AUM over $1B.

So who is the entity?

Looking through its transaction record, there are clues.

Even though it received $560M worth of BUIDL in the past 5 days, it currently only holds $436M

At the same time it transferred $196M BUIDL out to another wallet (0x54d0a1447e1431db925E871Ae799f23F408631A1)

Digging further, the second wallet looks to be a holding wallet for the BUIDL funds minted by the first wallet.

Adding the holdings of the two wallets together, there are a total of $632M worth of BUIDL.

If we were to figure out either one of the wallet addresses, we would work out who this BUIDL whale is. Drawing on my crypto detective skills, it is soon obvious that the wallet beyonds to the tokenized hedge fund basis trading project Ethena. See the social graph of the wallets below.

Let’s cross reference this with data with Ethena’s own.

Bull’s eye. $632M to the tee.

Why is Ethena deploying the money now?

Well to answer that question we need to understand where that 632M USDC that it allocated to BUIDL came from.

When I wrote about Ethena’s entry into the market, it had a single product called USDe - a portfolio of tokenized basis trading positions made up of Bitcoin, Ether, stablecoins. You can read more here to understand the mechanism better.

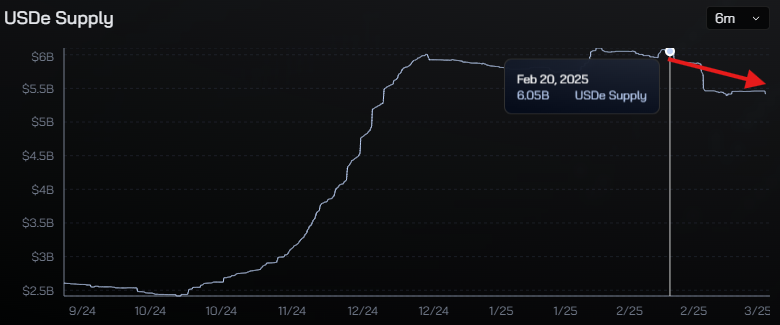

The key to understand Ethena’s motivation is buried in this graph.

The total USDe supply dropped from 6.05B on 20th Feb to $5.42B on 17th Mar. The $630M decrease in the supply matches exactly the increase in the BUIDL’s AUM attributable to Ethena.

Why the sudden 10% drop in market cap? The answer most likely lies in the yield (the carrot) that Ethena offers to attract depositors. When I wrote my research on them last year, they were offering 25% yield due to the high funding rates on Bitcoin and Ether at the time. Now the yield is at 3.72% - less than tokenized MMF products that have way less risks.

Given the declining yield spread between USDe and tokenized MMF, USDe as a product is not attractive for its target audiences - crypto depositors looking for juiced up yields.

So what to do? Ethena decided to cannibalize, or disrupt itself, depending on your perspective, to stay alive.

The money it could allocate towards BUIDL is a function of the USDe supply and its collateral makeup. Between 20th Feb and 17th Mar, Ethena has been systematically bumping its crypto collateral for stablecoins while experiencing a -10% change in the USDe supply. See charts below.

This suggests a deliberate decision to pivot away from USDe and into USDtb, the new stablecoin product backed by BUIDL.

So how much money is left in the juice box?

That depends on two key factors: whether staked USDe holders are willing to stick around as yields decline and how aggressively Ethena is willing to cannibalize itself.

At the end of the day, USDtb is meant to be 90% backed by BUIDL and serve as a reserve asset for USDe. Swapping collateral assets from BTC basis trading positions to T-Bills effectively caps the yield Ethena can offer, making it less attractive to depositors. The ceiling on returns is now set at BUIDL’s native yield minus fees—far from the explosive upside of the previous model.

The real signal to watch is the movement of top staked USDe yield sources in DeFi. The chart below highlights the three largest wallets—DeFi yield-generating strategies—which collectively hold $1.8 billion USDe, or 33% of total supply. Pendle alone accounts for $1.6 billion, while Aave holds $234 million.

If these balances drop by double-digit percentages, it would be a clear sign that investors are losing confidence in Ethena’s collateral strategy.

All signs point to Ethena abandoning USDe in favor of an all-in shift to USDtb.

In just a few weeks, Ethena has redirected 10% of its collateral into BUIDL—an implicit admission that its tokenized basis trading strategy is either unsustainable at scale or too reliant on market cycles.

The recent Securitize partnership on the Converge blockchain further cements this shift. Rather than doubling down on USDe, Ethena is betting its future on USDtb and other permissioned financial products.

Meanwhile, MakerDAO just announced a $500M allocation to BUIDL, reinforcing the growing brand power of TradFi asset managers within DeFi.

Currently, Ethena holds $5.4B in assets, with 50% in stablecoins. MakerDAO, a key competitor, sits on $5.5B in stablecoins and Treasuries—assets that could also flow into tokenized T-Bills. However, MakerDAO is less likely to move everything into BUIDL, given its access to off-chain T-Bills at a far cheaper 15bps cost versus BUIDL’s 50bps.

If Ethena converts 90% of its assets into tokenized T-Bills via USDtb and MakerDAO holds steady, BUIDL could see as much as $5B in additional AUM inflows.

Conclusion - The Real Test Begins

Behind the glorious AUM increases lie two glaring challenges facing the newly formed Ethena<>Securitize(by association BlackRock) alliance.

First, while Securitize may have gained instant access to billions in AUM, and Ethena gets an institutional facelift, Converge's exclusive reliance on crypto-native projects as launch partners exposes a glaring weakness: the absence of true institutional traction.

For traditional buyside players, tokenized T-Bills don’t solve a problem—they already have direct access to U.S. Treasuries at a lower cost. Current offerings simply add friction without delivering enough added value to justify moving capital on-chain.

For traditional sellside players, legacy platforms like Canton/Digital Assets and R3 Corda already command 100x the institutional presence, backed by deeply entrenched ecosystems. Ethena and Securitize are playing catch-up in a space where distribution—not just technology—is the key differentiator. Building those pipelines takes years and millions of dollars.

Second, Ethena’s original success with USDe was fueled by its frictionless, non-KYC onboarding, propelling it to $6B in AUM. In contrast, its new product, USDtb, demands full KYC for both subscription and redemption. And KYC’ed distribution is an area where neither Ethena nor Securitize has a strong track record. You can explore Securitize’s history here.

Crossing the $1B mark makes for a strong headline, but what truly matters is seeing the investor base double or triple in addition to AUM inflows. That would signal genuine adoption and expanding demand.

The challenge ahead isn’t technology—it’s distribution, trust, and adoption. And that’s a much harder game to win.

Comments