Tokenized MMFs are Ready for Institutional Prime Time

- Harvey

- Nov 7, 2025

- 3 min read

Updated: Nov 9, 2025

Here is the biggest tokenization developments this week almost no one is talking about - unless you’re a practitioner or a Tokenization Insight reader:

Global Digital Finance (GDF) has just published the industry’s most comprehensive paper for Tokenized Money Market Funds (TMMFs) as institutional collateral, supported by Ownera’s FinP2P network powering the interoperability between different systems.

This working group brought together more than 70 global institutions, spanning banks, asset managers, custodians, and legal advisors, to test one question:

Can tokenized MMFs function as legally enforceable, operationally viable, and regulatorily acceptable collateral under existing market infrastructure?

The answer: a decisive yes - for the $1T variation margin posted globally across derivatives markets in 2024 (ISDA Margin Survey 2024).

Through six live sandbox simulations orchestrated by Ownera, the group demonstrated that TMMFs can be transferred, enforced, and substituted in real-time across multiple ledgers and participants, all within the frameworks of EMIR, UCITS, and ISDA CSAs.

In this Weekly Research, I will breakdown the six test cases that proved TMMFs are not just viable but are ready for deployment today:

Bilateral posting and recall of collateral: testing title transfer and legal enforceability between two counterparties.

Automated margining: integrating margin engines and custodial systems for real-time, programmable collateral posting.

Depeg event and substitution: demonstrating dynamic collateral replacement during stress events.

Default and recovery: proving on-chain enforcement and redemption under insolvency scenarios.

Tri-party integration: connecting tokenized collateral with existing tri-party funding and repo infrastructure.

Legacy<>DLT interoperability and settlement: bridging SWIFT messages to on-chain settlement across multiple ledgers.

Together, these six simulations send a clear message: TMMFs are a production-ready collateral instrument today. Let’s dive in.

1. Simple Bilateral Transfer (Manual Margining of TMMFs)

Objective: Prove that TMMFs can be directly posted and received as collateral between two parties under an ISDA title-transfer CSA.

Key Actions: Manual posting and recall of TMMF tokens on a DLT.

Outcome: Validated legal enforceability and title transfer of TMMFs in bilateral collateral exchange.

2. Integrated Margin Calls (Automated Posting via Third-Party Systems)

Objective: Demonstrate automated collateral posting triggered by a third-party margining engine integrated with tokenized fund infrastructure.

Key Actions: 1) Margin call triggered via 3rd party collateral management system 2) Smart contract executes straight-through TMMFs collateral posting.

Outcome: Proved integration readiness of TMMFs into existing EMIR/ISDA margin workflows.

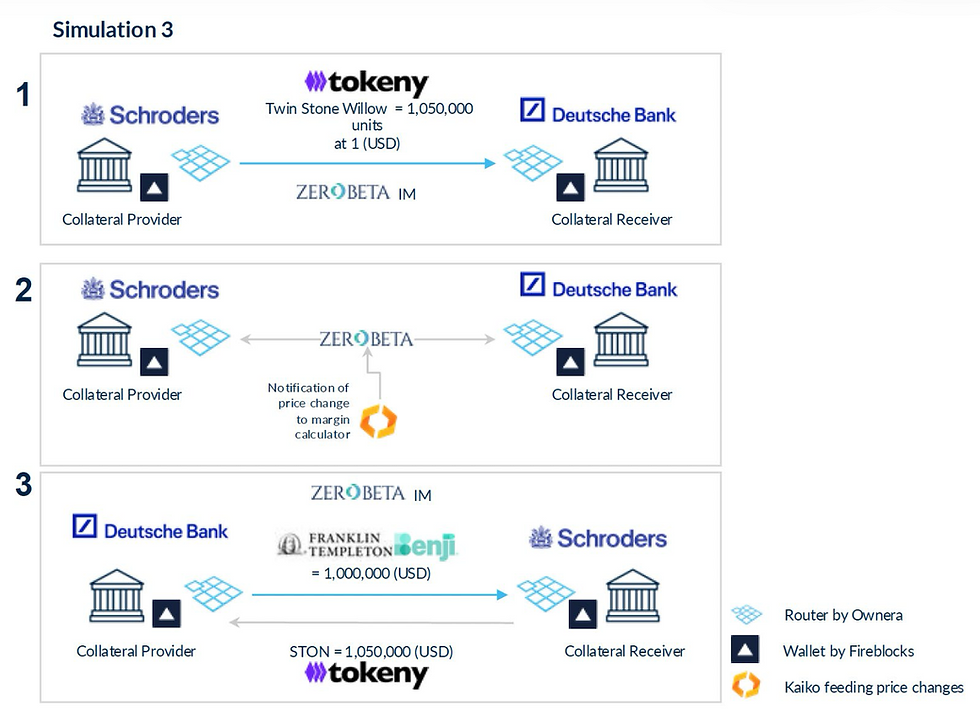

3. Depeg Event and Substitution (Dynamic Portfolio Management)

Objective: Test stress conditions, such as a fund depegging or gating, and validate real-time substitution of collateral.

Key Actions: 1) Simulated NAV depeg triggers TMMF substitution logic in smart contract 2) Automated replacement with another eligible TMMF token.

Outcome: Demonstrated programmable, real-time collateral management under market stress.

4. Default Scenario (Enforcement and Recovery in Insolvency)

Objective: Validate enforcement rights of TMMFs in case of counterparty default - crucial for regulatory and legal certainty.

Key Actions: 1) Default event under ISDA CSA triggered 2) Collateral taker redeems TMMF tokens on-chain via smart contract 3) Cash payout settled in fiat and tokenized bank money.

Takeaway: Confirmed that tokenized collateral is enforceable under insolvency law - a key regulatory milestone.

5. Funding of TMMF in Tri-Party (Collateral Reuse/Intraday Liquidity)

Objective: Show how TMMFs integrate into tri-party and repo workflows, enabling reuse and funding mobility.

Key Actions: 1) Commerzbank post IM in TMMFs to UBS 2) UBS enters into a 10min repo leveraging TMMF as collateral and gain cash in Fnality tokenized cash 3) State Street managing the tri-party transaction.

Outcome: Bridged tokenized MMFs with existing tri-party funding infrastructure.

6. From SWIFT to Settlement in Seconds (Legacy–DLT Interoperability)

Objective: Connect legacy messaging (SWIFT) with traditional FIX trading system and on-chain settlement, providing practical intraday funding.

Key Actions: 1) Traditional SWIFT message triggers on-chain collateral transfer via FinP2P 2) Multi-ledger atomic settlement executed and confirmed instantly

Outcome: Proved that tokenized assets and commercial bank money can integrate with existing financial infrastructure to enable at-scale adoption of TMMF as the collateral of choice

Conclusion

The six test cases collectively proved that TMMFs are legally enforceable, operationally viable, and technologically interoperable across major jurisdictions and financial infrastructures.

Ownera’s FinP2P served as the interoperability layer connecting multiple ledgers, custodians, and margin systems.

State Street, Goldman Sachs, BNY Mellon, Northern Trust, BlackRock, and LSEG represented the leading institutional players proving this concept in action.

Together, they demonstrated that TMMFs are production-ready collateral instruments that can operate within current market, regulatory, and legal frameworks - from SWIFT messaging to on-chain settlement.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Comments