What is the future for stablecoins and tokenized deposits - according to Citi?

- Harvey

- Oct 1, 2025

- 4 min read

Updated: Oct 15, 2025

Citi Institute published its annual stablecoin report. It has done such a great job at articulating the digital money revolution, I am going to dedicate this Weekly Research note to unpacking and contextualizing its top 3 takeaways.

Instead of reading all 54 pages, here’s 3 key highlights distilled into 3 mins for you:

Stablecoins may be especially useful for digital-native firms, retail users, and frontier markets. For developed markets where instant payments already exist, stablecoins are likely to face stiff competition from tokenized bank deposits.

There is NO one size fits all solution. The precise use cases are to be determined by a combination of regulatory, privacy and risk appetite.

In 7 out of 9 modeled payment volume scenarios, tokenized deposits win out over stablecoins.

Let’s dive in.

30s Summary

“Stablecoins may be a vital addition to the finance toolkit, especially for digitally

native companies and investors, as well as frontier market households looking for

an easy way to hold dollars. But for many, bank tokens – deposit tokens, tokenized

deposits and similar – will be an easier integration.” Citi Institute, Stablecoin Report 2030

Stablecoins were invented as a cash instrument substitute for crypto trading a decade ago. Yes, you’ll often see headlines citing $20T+ in annual stablecoin volume but nearly all of that is crypto trading. The real payments usage is closer to $60B-$80B a year as of Q1 2025.

By comparison, JPMorgan’s tokenized deposit product is seeing $3B in daily transaction volume or $90B a month. And adoption of tokenized deposits are starting to pick up steam. For example: Citi, HSBC and JPMorgan - the three GSIBs with tokenized deposit products - are expanding their offering coverage both in terms of geographies and FX options.

However, I expect stablecoins payment volume to surge following Stripe’s Open Issuance and ChatGPT’s eCommerce integration. Consumers will demand “earn till I spend” soon. And currently stablecoins are uniquely well positioned to do that vs tokenized deposits.

Highlight #1

“Domestically, for consumers and smaller merchants, real time domestic payments exist in 80+ countries. Cross border, these payment speeds slow. Internet based communication or financial transfers do not slow due to borders.

The digitally native or crypto native firms are running ahead of traditional corporates on stablecoin implementation. However, as we will discuss in detail below, not all corporate treasury operations are set up to operate 24x7, nor do all want such a flexibility.”

As I highlighted in Stablecoin Monetization Demystified: Flow Business pt.2, stablecoins’ key payment traction are found in emerging market USD access and the related cross-border payment use cases. In many developed markets, instant payment rails already exist and being used at scale.

Of course, stablecoin players may still go after retail and SME use cases, in an attempt to capture market share. Though for corporate and high-value payments, the pitch is much harder for domestic markets where instant payments already are entrenched.

The next time you hear that stablecoin is “faster, cheaper and better”, remember the hidden frictions: on/offramping, FX conversions using USD as the intermediary leg, and regulatory compliance discount.

And as I noted on Citi Treasury Innovation: “Instant payments and instant liquidity for corporate treasurers are more than just a technological solution. They require organizational readiness in human capital, back-end processes and third-party vendors.”

Highlight #2

“Multiple on-chain money formats will co-exist. Use of a specific format will be

dependent on characteristics such as trust, interoperability, and regulatory clarity.”

Instead of one size fits all, the adoption is case dependent. Regulatory clarity and trust being priority concerns for institutions.

The key question they ask is: What’s the simplest way to unlock benefits like 24/7 availability, instant settlement, and programmability - without triggering complicated risk reviews?

That’s where tokenized deposits stand out. Institutions and corporates are already bank clients. By delivering the outcomes they want within the trusted banking framework, tokenized deposits can be adopted seamlessly. No extra risk committee approvals, no operational heavy lifting.

Stablecoins, by contrast, shine in a different segment. Their main edge lies in yields, rewards, and open access. These benefits are especially attractive to retail users and SMEs who can’t get those opportunities through traditional banks.

For a deeper dive see Why tokenized deposits is a MUST for every bank? Pt.2

Highlights #3

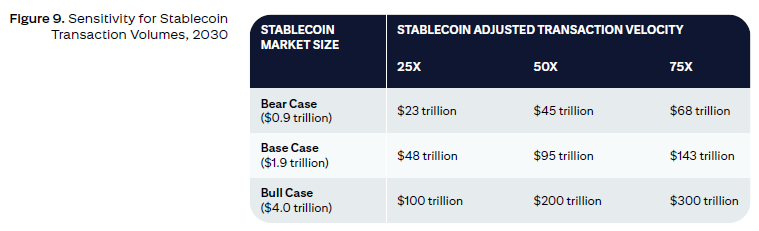

If you are considering payment monetization strategies, the actual payment volume projection numbers are actually in favor of tokenized bank deposits in 7 out of 9 scenarios.

But the more interesting and meaningful question is how will that payment volume be divided up amongst use cases.

Here are the most important verticals I am watching:

Capital markets

Tokenized deposits: JPMorgan’s partnership with Marex

Stablecoin: Circle’s MOU with Deutsche Borse

B2B payments and corporate treasury.

Tokenized deposit: Citi’s recent integration of Citi Token Services with its 24/7 USD Clearing

Stablecoin: SpaceX’s usage of Bridge in its corporate treasury function.

Global payroll and merchant payouts

Tokenized deposit: n/a

Stablecoin: Worldpay collaborating with BVNK

Consumer remittances

Tokenized deposit: n/a

Stablecoin: MoneyGram’s USD account launch in Columbia

Retail payments

Tokenized deposit: n/a

Stablecoin: Visa and MasterCard powered crypto cards such MetaMask Card

Of course, to understand deeply about the traction and competitive dynamics in these battlegrounds, we need a close up view on these key use case adoption trends.

Stay tuned.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Comments